Expanding Impact Funding for Government Social Program Contracts

The Pay For Success (PFS) field is evolving from initial Social Impact Bond-style projects launched by governments and supported by third-party (i.e., non-government) funding to agency and multi-agency engagements that shift the practice of how existing public funding streams are deployed for specific social programs. Across these projects, traditional cost reimbursement service contracts are being amended or replaced with outcomes-oriented contracts.

Scaling the systems that implement these new outcomes-oriented contracts for urgently needed social service programs requires funding, but some of the original funders who supported early project SIBs are “waiting on the sidelines” to see if real outcomes are validated from these original investments. Meanwhile, the above transformation is proceeding and new private and public funders are needed. Third Sector believes that if we can demystify the work stages and risks involved in broader outcomes-oriented engagements, we can demonstrate a number of new funding opportunities that might appeal to both new and traditional investors and align with their respective investment guidelines.

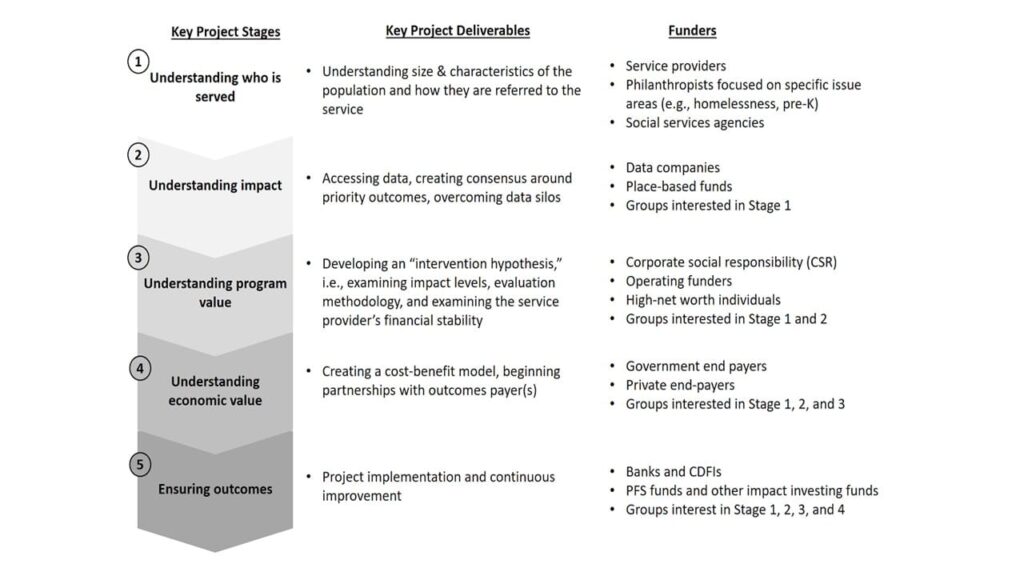

In contrast to traditional projects, these newer projects will look very different for respective stakeholders, and funding needs differ accordingly. Below, we map how these different project stages overlap with the landscape of current funders. Why are these transformative projects exciting new stakeholders?

- Moving from SIB-style unique projects to broad social issue outcomes-orientation: Some outcomes payers, like governments, may seek more efficient outcomes contracting for current funding streams and not seek new third-party funding as in former PFS models.

- Expanded funding based on enthusiasm for outcomes: In other cases, program funders (e.g., foundations) may be so excited by how an outcomes orientation can help encourage and measure real life improvement for local citizens that they may focus their Program-Related Investment or Mission-Related Investment funds to scale worthy existing programs directly versus specific projects.

- Engagement by entirely new third-party stakeholders: Employers, frustrated with their inability to hire sufficient entry-level staff, are considering hiring agreements with local workforce boards and service providers. Employers will pay outcomes or bonus payments to service providers via agreements over two or three years for training youth for specific positions requested by employers. Service providers can use these payments to scale and serve additional individuals. Leveraging private financing to create individualized career pathways generates powerful outcomes for both the young adults served and the broader economy.

The above examples are exciting. But, every funder will want to consider what their entry point should be for investing. Below, we provide a framework for funders to see and understand key project development stages. When listed deliverables are reviewed during due diligence, funders will gain comfort and confidence to fund the project(s) in some way.

Traditional funders of outcomes-oriented technical assistance, contracts, and service providers continue to be important and include:

- government-sponsored initiatives (e.g., the Department of Housing and Urban Development and Department of Justice Pay for Success Initiative)

- philanthropic funders (e.g., Living Cities and the Kresge Foundation)

- high-net-worth individuals (e.g., the Ballmer Group)

- academic institutions who have been important evaluation design partners in much of the data analytics work required to launch outcomes-oriented contracts

- banks and impact investors who have provided senior debt, junior debt, and grants in the construction stages of the project, helping bridge the timing gap between social service program provision and outcomes payments from traditional government end-payers.

The future market for outcomes-oriented contracting initiatives with governments is going to be expansive. While very exciting for our PFS field, we’ve pointed out here that funding liquidity beyond traditional funders has to improve at early development stages of these projects for a sustainable long term market to be achieved. We hope that this first blog will encourage new investors to consider the impact opportunities and learn how to address the real challenges for investing in an outcomes oriented contract world.