Pandemic Emergency Finance Bonds

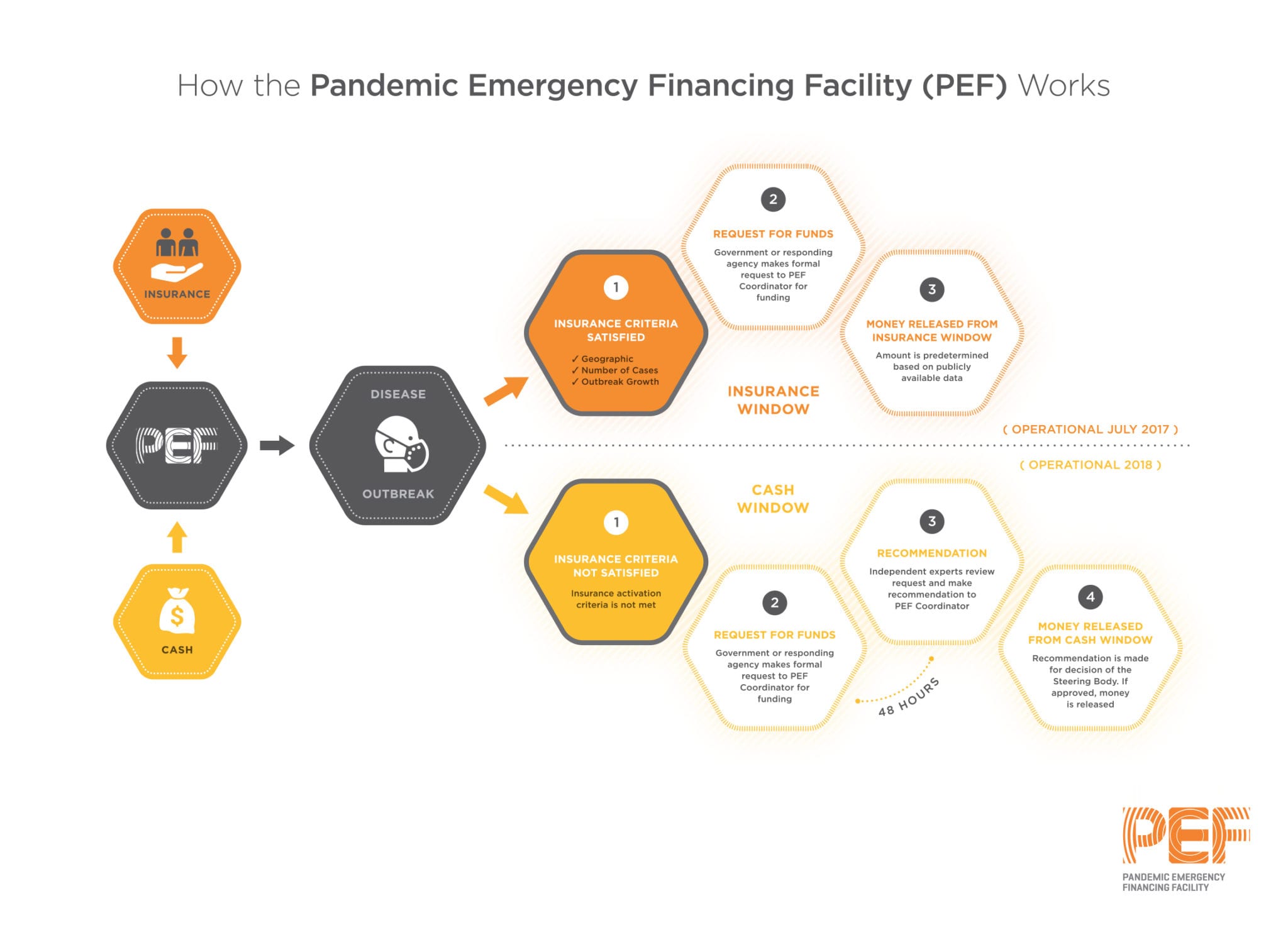

A few weeks ago, the World Bank launched the Pandemic Emergency Financing Facility” (PEF).[1] It is an exciting example of social financing supporting outcomes at scale. Here’s how it works. It has raised $425m via bonds and swaps. If no pandemic occurs, investors will be repaid their principal in full, plus a return. If a pandemic occurs, then investor principal will be instead used to quickly respond to the crisis. In short, the PEF functions as a kind of insurance that kicks in in the event of a bad outcome.

Third Sector has been working on pioneering a new form of PFS financing that also resembles insurance– the Social Impact Guarantee (SIG)[2]. With a SIG, a government pays for a social service – say reducing recidivism – just as it normally would: on a fee for service basis. But the government carefully tracks outcomes. And if those outcomes are not achieved, the guarantors pay the government back for some or all of the money it has spent.

Third Sector has been working on pioneering a new form of PFS financing that also resembles insurance– the Social Impact Guarantee (SIG)[2]. With a SIG, a government pays for a social service – say reducing recidivism – just as it normally would: on a fee for service basis. But the government carefully tracks outcomes. And if those outcomes are not achieved, the guarantors pay the government back for some or all of the money it has spent.

Our immediate question is: what are the possible lessons from the PEF for the Pay For Success space, in particular for SIGs?

We have three initial thoughts.

- Framing. Potential SIG guarantors have sometimes shown reluctance because their funds are not directly deployed to drive social change, but are held in reserve in case of a bad outcome. In short, it can feel like "paying for failure" instead of “paying for success.” How did the World Bank succeed in creating the PEF?

- One hypothesis is that the PEF is framed in a way such that funds are more closely tied to services. If the PEF is triggered, funders are paying for emergency relief services. By contrast, a SIG returns the funds to the government’s general ledger.

- If this is correct, then the lesson for a SIG is that it needs to specify upfront what alternative program(s) will be funded should the insured one fail. For example, a government could create a rank-ordered list of programs it wants to try in sequence. The government pays for the first intervention in the rank ordered list, and executes a SIG. And should the first intervention fail to work, the payout from the SIG will be used to pay for the second intervention on the list. That way, a guarantor knows that even in the event of a payout, their funds will be used to support a related set of services.

- Meeting funders where they are. Pandemics are closer than social services to where insurers work and understand risk – social services involve execution risk and more layers of human factors. Furthermore, the World Bank met lenders ’where they were’ in existing capital markets, using a mixture of bonds and swaps. If a SIG is to get to scale, there may be three questions worth asking:

- Are there particular issue areas that are as close as pandemics are to where insurers currently work

- For those issue areas that are not close to where insurers currently work, what would it take to help insurers diligence the additional layers of risk

- Could swaps or other such instruments enable a SIG to tap into large existing capital markets?

- The Benefits of Scale. Counterintuitively, perhaps bigger is easier. The SIGs we have explored are all for contracts of around $10m. Just as it is said that banks will default on small lenders and renegotiate with large lenders, impact insurance may be easier at a large scale that at the scale of a typical SIG. If this is right, then:

- Could there be something done at a state-level scale, such as where the state implements justice reinvestment reform, and if recidivism goes up, the insurer pays.

- Alternatively, similar to an epidemic fund, could something like an opioid addiction emergency fund pay for a swathe of education, prevention, and treatment services in the early stages of a crisis?

These questions and others remain to be worked through. For example, one large worry with any insurance mechanism is moral hazard. That is, governments could end up being less prepared because they are insured. In the case of the PEF, perhaps funders felt that the ability for developing country governments to fund preventative measures was limited in the first place, with or without insurance. In the developed world, that may not be the case.

We are excited by this innovation, and would welcome thoughts from partners in the field as we continue to develop new tools to tackle our most pressing problems.

[1] Link to Reuters https://www.reuters.com/article/us-global-pandemic-insurance-idUSKBN19J2JJ

[2] Link to SIG blog piece http://www.thirdsectorcap.org/blog/social-impact-guarantee/

Image source: http://www.worldbank.org/en/topic/pandemics/brief/pandemic-emergency-facility-frequently-asked-questions